Key Takeaways

— Total Liquidity Provided increases by 30% MoM

— New borrower pools for Nibbio, Bastion Trading & Alameda Research

— Clearpool Oracles and Staking to be launched on 10 October

— CPOOL continues to gain traction during bear market

Introduction

September has been another month of growth for Clearpool across all metrics. The team has continued to build, ship and deliver, leading to solid growth in the face of macro headwinds which have created challenging times for the wider industry. Clearpool has bucked the trend on a number of fronts, including a stellar month of expansion for Total Liquidity Provided and Total Loans Originated. New products have been delivered and new borrower pools launched, increasing recognition of Clearpool as a standout project and CPOOL as a standout asset during this bear market.

Protocol Performance

Clearpool maintained healthy growth across all metrics throughout September, despite continued volatility in the broader digital asset and macro market environment. Total Liquidity Provided to the Clearpool protocol peaked at above $145m in September, representing an increase of 30% month-on-month, in contrast to the wider DeFi market, where TVL dropped by 26.7%*.

The number of unique wallet addresses interacting with the Clearpool protocol increased by 49.7% as we continued to see the community expand and new lenders migrate from other lending platforms.

Three new borrower pools were launched in September: Alameda Research launched a permissioned pool, whilst Bastion Trading and Nibbio both launched permissionless borrower pools. The Bastion and Nibbio pools both experienced a very impressive launch, each surpassing $5m within a week of launch, indicating a strong supply of liquidity from LPs and in line with TLP increase.

The Alameda pool was launched with $5.5m of liquidity, supplied by Compound Capital Partners and Apollo Capital, and remains open to new lenders. The pipeline of borrowers continues to expand on the back of an increase in organic requests, introductions, referrals and the team’s continued business development efforts. Interested lenders to Alameda should contact bd@clearpool.finance.

*Calculation based on DeFi Pulse TVL.

Product Releases

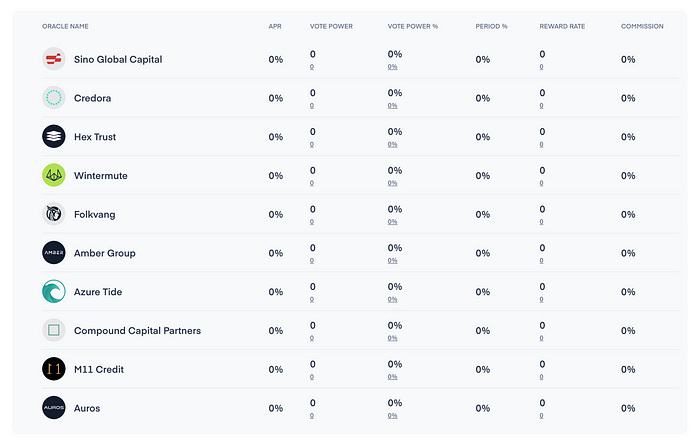

Development work in September focused primarily on the Oracles and Staking product which will launch on 10 October. Both the Oracle voting mechanism and the Staking contracts have been extensively tested, with a number of dry-run Oracle voting rounds executed during September.

In addition to Oracles and Staking, development has begun on Clearpool’s new permissioned product, which is scheduled for launch later in the year. Finally, several enhancements were made under the hood of the website and app to improve speed and security.

Oracle Testing Results

The team has been very impressed with the level of interest, application and commitment shown by the first cohort of Clearpool Oracles that participated in testing. The results obtained through these tests were twice used to update the current Interest Rate Model (IRM) curve, a testament to the quality of inputs and results obtained through the testing process. The below charts represent the distribution of inputs from the most recent test epoch, with the blue columns indicating successful votes.

In the above charts, Y0, Y1 and YM represent the initial, highest and lowest interest rate points along the IRM curve. For more details about the Interest Rate Model, please click here.

CPOOL

CPOOL continues to gain significant traction. Both 24-hour trading volumes and DEX volumes have been trending upwards. Meanwhile, the number of unique addresses with CPOOL holdings has reached new highs. Smart money holdings also remain consistent at near all-time highs.

Charts: Nansen.ai

Community

Following multiple requests from the community, Clearpool launched its Discord server in September. Discord provides Clearpool and its community with a more structured platform where conversation, questions, announcements and support can all take place in dedicated channels. Although we will keep the official Telegram chat, we urge the community to use Discord, where the team, ambassadors and community managers will be available to join the discussion.

Total Loans Originated crossed $250m and then quickly rose above $300m during September, a milestone which is being celebrated with a campaign to encourage members of the community to tweet about why the crypto community should take notice of Clearpool using the hashtag #Clearpool250MContest.

Co-founder and CEO Robert Alcorn was invited to the Polygon podcast to talk about the future of unsecured institutional lending, interest rate swaps and $CPOOL tokenomics and conducted an AMA with the Micryptomundo Spanish-speaking community.

Media Coverage

Token Insights: https://tokeninsight.com/en/news/alameda-research-joins-clearpool-s-permissioned-pool-ecosystem

Summary

September was another eventful and groundbreaking month for Clearpool. As we now move into Q4, we are excited to see the launch of Clearpool Oracles and CPOOL staking, which will provide a critical function to the ecosystem and further utility for the Clearpool governance token. Development of the next iteration of the permissioned product continues, and more product enhancements will soon be implemented. A robust pipeline of permissionless and permissioned pools will drive sustained growth of the protocol through the rest of the year.

Download the monthly report.